Jay Chen, CFA, PhD

Elnora H. and William B. Quarton Professor of Business Administration and Economics, Coe College, IowaValue Is Dead, 10/18/2022

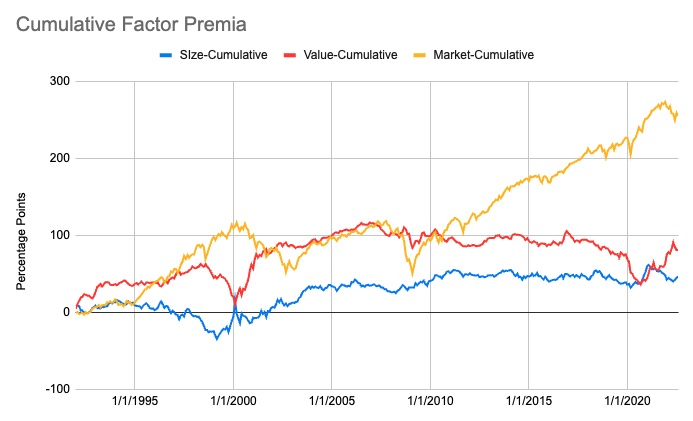

While teaching value investing (not a fan), I came up with the idea of drawing Fama and French’s factor premia over time, cumulatively. I am pretty sure other people must have done similar work before, but the period post-”Beta Is Dead” paper shows that the value effect might be really dead now. The size effect was pronounced dead even earlier. See the chart below.

In 3 decades’ time, the value premium added about 81% in returns, but most of the gain happened after the revival of value investing during the period post-dot com bubble. It declined after that. Even 2022's reversal was short-lived. What happened?

Fama used to explain the value effect as a risk premium. I like this explanation better than the behavioral one (humans are too dumb to realize how good value stocks are). I like it because it explains why the effect can last for a long time. But now that the effect disappeared, can you just say the risk premium is cyclical and keep waiting for the better day to come? I know that people like Asness prefer this, but are there reasons, business and financial reasons, why value is not coming back?

Seth Klarman said back in 2010 that two possible reasons why value is gone: (1) business competition is getting more and more serious. A beaten stock is a beaten business. A beaten business has a good chance of going out of business. Hence no bounce. And (2) LBOs serve as a price floor for the value stocks. Once decent stocks go down in value, they get picked up by private equity. In a way, LBOs cherry pick the falling angels and those low-valuation stocks left behind are truly bad. No bounce, either.

I might add one more explanation. Every time I google value funds, there are a ton of them out there. If you are a true market believer like me, you’d think they would have driven out the value premium. And they have, in my mind.

Back to homepage.