Jay Chen, CFA, PhD

Elnora H. and William B. Quarton Professor of Business Administration and Economics, Coe College, IowaIs Costco the Best Stock Ever, 9/2/2022

In the latest interview, Charlie Munger again touted Costco. He doesn’t own many stocks. He named Costco right after Berkshire Hathaway. If he practices what he preaches, Costco must be one of the four great ideas of his life.I like Costco very much, too. I have an autopilot plan to add to my Costco position. Earlier this year, when Costco dropped with Wal-Mart’s inventory woes, I urged people to buy Costco. It was a rare occasion in which the discount retailer offered a discount to its stock. I wish I had bought more. It now more than recovered from its loss due to the sympathetic move with Wal-Mart. Costco is down by about 8% YTD, but the S&P has the worst year-to-date performance in 80+ years!

Over time, the S&P 500 offers about 10% a year in returns. Costco has done about 20% a year. If you look at these legendary investors, they mostly have accomplished about 20% a year. So if Costco is your 1-out of-4 best idea in life, you are among the greats. It is a gem hidden in plain sight.

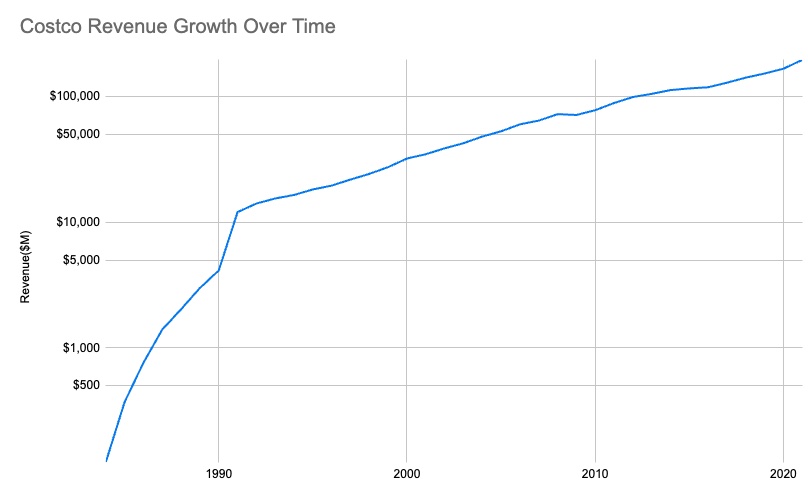

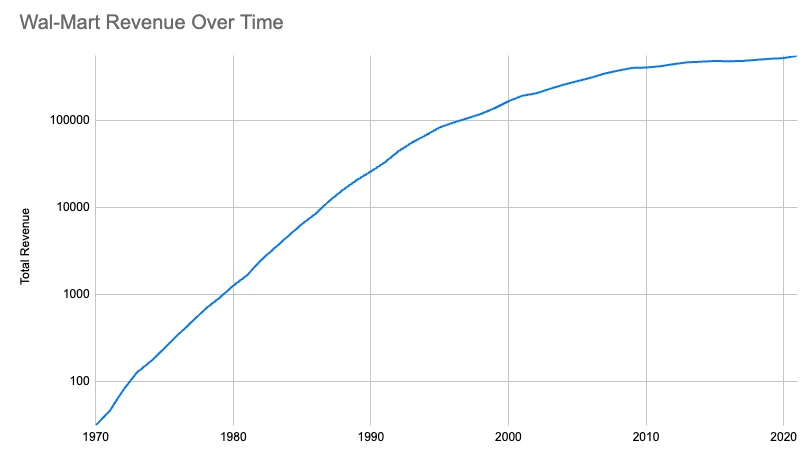

The question to ask then is whether Costco can continue to give us 20% return a year. The following two charts say yes.

I use a log scale to show the growth rates. Remember that the slope of logged numbers is the growth rate. As you can see, Wal-Mart’s growth rate is approaching a flatline. It has saturated the market. On the other hand, Costco’s revenue growth rate remains to be around 10% a year. It has been like this for 3 decades. It controls its expansion pace with a steely discipline. It intentionally changed the growth strategy in the 1990s. That strategy avoids Wal-Mart-like fate. Now it simply means that Costco can still grow for many, many years. Sometimes I wonder why I didn’t put all my money in Costco.

Back to homepage.